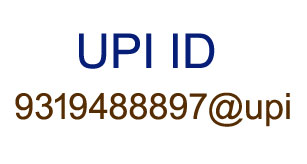

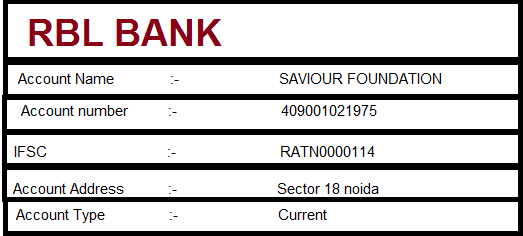

Donate

Why Donate?

Your support is crucial to our work in improving the lives of India’s children. Please consider donating to Saviour Foundation today and helping us give them a chance at a happier childhood. Plus, you can receive a 50% tax exemption for your donation. Thank you for your love and generosity.

Why Donate to Savior Foundation?

Why do you donate to the Saviour Foundation?

Saviour Foundation provides a number of causes to donate. Our foundation works for the welfare of the people of different sections. We work for poor people, children, aged persons and also to someone who is facing any health issues.

What will be the benefit of our donation to the poor people?

Your one donation can make the future of any child better through better education. Your one donation can provide food to someone who really needs that.Your one donation can be helpful in the treatment of any sick who can’t afford better health services. Your one donation can bring smiles on many faces. So donate for a good cause.

Why donate for a cause for Saviour Foundation?

You can donate here for any cause you want like for the food of poor people, for the education of children, to provide better health facilities who can’t afford it and many more..

Which donation is eligible for 50% deduction under 80G?

Section 80G deduction of the Income Tax Act is allowed for amount paid by the taxpayer as donation to any fund or institution or charitable Trust.

Is it necessary to donate?

It helps people in need, and it helps people in your community. When you give, others live. Donors, especially those who donate regularly, keep our nation’s blood supply stable.

What will Saviour Foundation do with my donation?

As soon as the donation through cheque or online is reconciled by the bank, the amount is allotted to the specific programme, which it has been meant for. The utilization and results are managed, monitored and audited. The outcome is reflected in the annual impact report, which is shared with the donors.

What’s better, monetary donations or usable items?

Both types of charity are beneficial as far as the tax benefits are concerned. For people who can make time, we suggest they personally visit the NGO and make their contribution of any type. Either money or items or time.

Donate to Saviour Foundation for girls education?

Your donation towards our organization for supporting Mission education 5000 will ensure that girls in remote villages of India are enrolled, retained in school and are also learning well.

How can we support for Saviour Foundation?

The best way to support Saviour Foundation NGO is to tell others about it and ask them to support it. You could recruit friends as volunteers, convince colleagues to take part in certain activities or ask family members to share about the organization to their friends, creating a second, larger wave of awareness.

Why donate to Saviour Foundation for Old Age Home?

With the endless support of kind-hearted people from all over India, since the old age home help project Mission Meri Maa’ was established in Saviour Foundation is able to serve an estimated elderly people from living a further miserable life.

What is donation benefit in income tax?

Section 80G of the Income Tax Act, 1961, allows taxpayers to save tax by donating money to eligible charitable institutions. By donating to eligible institutions and organisations, taxpayers can claim deductions ranging from 50% to 100% of the amount donated.

What information is sent to the donors by Saviour Foundation?

The donor gets an instant acknowledgement mail along with an SMS. On receiving the reconciliation statement from the bank, a receipt is sent via email immediately, followed by a hard copy by post (within India). The receipt is accompanied by a ‘welcome pack’ which is also a token of appreciation.

Is the donated amount rightly used for Poor People?

To ensure that the donor is rightly informed about the expenditure of their donations, Saviour Foundation or any registered NGO will follow a strict post-donation procedure and bills for the same are duly shared.

What are the Tax benefits that a donor will get?

A donor will get 50% of tax exemption on the donation under section 80 G of Income Tax Act, 1961.